Employee Benefits Insurance - Retirement Benefits, Challenges and Options

|

In the continuing global slowdown, choosing a smart, affordable Employee Benefit Program that can help companies and corporations acquire and retain a highly motivated and performing workforce is one of the challenges facing employers. In addition, increasing medical cost, warning of unsustainability of social insurance fund in near future and Global influences are some of the key reasons that employers consider retirement planning - Voluntary Pension Insurance for their employees is critical.

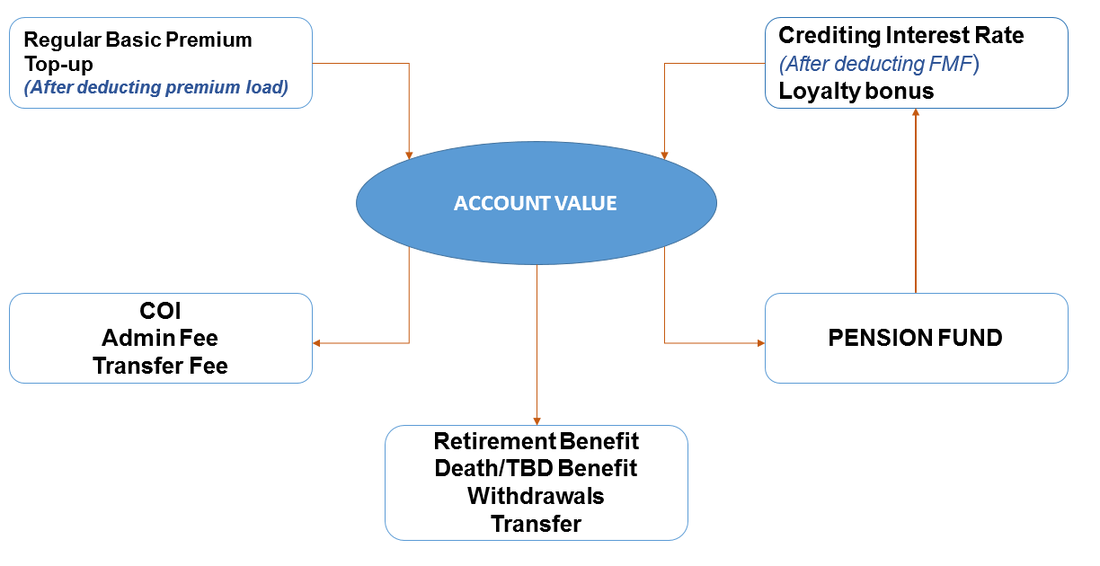

In regard to the above matter, please be noted that according a conference to discuss the implementation of the amended Law on Social Insurance in March, 2015, there are only about 20 per cent of the workforce are currently contributing to the social insurance fund. Companies and Corporations, therefore, consider to purchase Voluntary Pension Insurance for their employees not only protect the financial security for employees in their retirement but also contribute to encourage, raise the awareness of individual/ people and/or perceive benefits of product. Voluntary Pension Insurance is extremely new in our market and there is only one (or maximum two) life insurance companies who are willing or looking to provide their offerings thus insurance program will be designed to provide flexible retirement payouts and easy, convenient access to confidential and updated pension account reports anytime, anywhere. A group pension scheme has a number of elements, but the keys ones are:

AEGIS, one of the first insurance intermediary to initiate, have been and are working closely with one of leading life Insurance Company prior to their initial launch of this Voluntary Pension Product into the market. We understand this Product thoroughly, in addition some of our directors are qualified international financial advisers which is inclusive of life & benefits products.

Please visit our Voluntary Pension Insurance to obtain additional information or call us on +84 (08) 3514 7965 or email us at [email protected] for further advice! |

Have a query or question? Please call or email us for further advice on +84 (08) 3514 7965!

|